Standard tax rate: 20%

Number of filings per year: 4

Standard tax rate: 19%

Annual filing times: 13/5

Standard tax rate: 22%

Number of filings per year: 13

Standard tax rate: 20%

Number of filings per year: 5

Standard tax rate: 21%

Number of filings per year: 5

Standard tax rate: 23%

Number of filings per year: 12

Standard tax rate: 21%

Number of filings per year: 12

Standard tax rate: 21%

Annual filing times: 12/4/1

Standard tax rate: 20%

Annual filing times: 13/5

Standard tax rate: 25%

Annual filing times: 12/4/1

Standard tax rate: 21%

Annual filing times: 12/4

Standard tax rate: 5%

Number of filings per year: 4

Standard tax rate: 16%

Number of filings per year: 13

Certification

ACCA member + FCCA member = professional and reliable

Certification

ACCA member + FCCA member = professional and reliable

Best for you

VAT solutions

Meamaz

for your tax agent

Meamaz

As soon as one day

Exclusive customer service

Follow up all the way

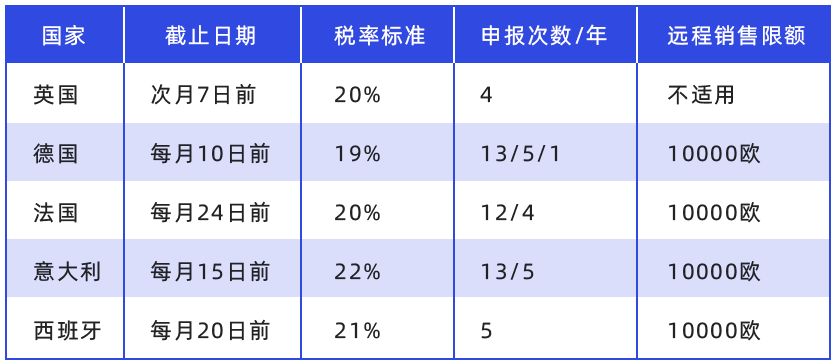

Similar to china value-added tax, the full name of VAT is VALUE ADDED TAX, which is the after-sales value-added tax commonly used in EU countries, that is, the profit tax on the selling price of goods. When the goods enter the UK (according to EU law), the goods are subject to import tax; when the goods are sold, the merchant can refund the import VAT, and then pay the corresponding sales tax according to the sales. Overseas companies or individuals, as long as they place the goods in the EU and generate sales, must apply for a VAT number and pay after-sales VAT.

Use the local warehouse in Germany for delivery or the goods are located in Germany, and the distance sales exceed 10,000 euros.

3-6 months, and the time limit for transfer agency is generally 2-4 weeks (except for force majeure factors).

No, you need an account to apply for German VAT. There is no fast track, you can only go through the normal application process.

Since the registration of VAT needs to submit the registration subject information, if multiple accounts are used, the registration information will not be able to match. Once the tax bureau inspects, there may be no opportunity to plead, and the listing will be directly frozen and the funds will be frozen.

Whether or not to apply for a tax number depends on 1. Whether there is any local inventory; 2. Whether the distance sales have exceeded the limit; 3. Whether the main market is here.

Pay special attention to the first point. Sellers who have participated in the pan-European plan should first check which country the product has been dispatched to by Amazon. Now, Amazon’s self-check and inventory are required to be bound with a tax number; the second point is that it must exceed remote sales. It is necessary to apply for the tax number of the country and declare it in the country.

There are three main tax rates in most EU countries: standard tax rate, tax reduction rate, and zero tax rate. The following is a classification of common VAT tax rates in some EU countries:

UK: 20%, 5%, 0%;

Germany: 19%, 7%, 0%;

France: 20%, 5.5%, 10%, 0% ;

Italy: 22% , 5%, 10%, 0% ;

Spain: 21%, 10%, 4%

Poland: 23%

Czech Republic: 21%

To set up the closing of the pan-European plan, the seller must first enter the Amazon operation background:

1. Click "Settings" in the window menu bar to expand the last item of the column.

2. Select "Fulfillment by Amazon".

3. Select "Fulfillment by Amazon European Integration Service" and select Disable.

As any individual or company, when importing goods into the UK, the customs will levy import duties on their goods, including customs duties (IMPORT DUTY) and import value-added tax (IMPORT VAT). They are calculated as follows:

IMPORT DUTY = Declared value X Product tax rate (the tax rate here refers to the tariff rate)

IMPORT VAT = (declared value + first freight +DUTY) X 20% (merchant can deduct it in quarterly declaration)